At the start of the new year in January 2019, Y-Combinator, announced to open source their Series-A Term Sheet with the ambition to contribute to the development of an industry standard for venture deal terms. Y-combinator not only published their standard investment terms, they also provided a detailed explanation on why those terms exist. “We are going to make this easy, friendly, standard and fast”. The Y-Combinator Series-A Term Sheet marks a milestone in the standardisation of venture deal terms.

Another example of a venture deal standard is the Convertible Loan Note (CLN). In only a few years the CLN has become the default instrument for venture teams to quickly arrange funding in anticipation of a capital raising process. Many templates of the CLN are freely available on the internet.

For new ventures with the ambition to raise venture capital, standardised venture funding documentation is easy and fast. They draw upon proven models and ensure that the startup’s governance is prepared for future funding rounds.

Despite the ease of standardised investment templates, they may not provide the right solution for ventures that don’t fit in the venture capital model. Many alternative investment models exist such as corporate partnerships, joint ventures, venture debt, crowd funding, revenue share and IP deals, combinations of growth capital and secondary transactions and earn-ins. There is ‘no one size fits all’ model. Unfortunately, tailoring a transaction goes hand in hand with increasing deal complexity.

A venture funding deal creates a foundation for future collaboration between the venture team and its investors. Please note the difference with the ‘zero-sum’ nature of M&A negotiations whereby the acquirer buys the company from the seller. Consequently, effective venture funding negotiations require full alignment on the needs, objectives and requirements of the company, its founders, and investors. Even though alignment intuitively makes sense and this happens through discussions on business plan, technology roadmap, team, funding need and valuation, so far no deal structuring framework exists for founders and investors to align on the company needs, founder objectives and investor requirements.

In this article, I will introduce the Term Sheet Quadrant, a framework for founders and investors to design the optimal deal terms. The Term Sheet Quadrant takes into account the needs, objectives and conditions of the company, founder and investor from the perspectives of the funding need, investor return, valuation and risk management.

The Term Sheet

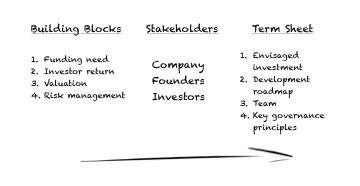

For most entrepreneurs a funding round is the first time they bring an outside shareholder on board. As most venture investors are active shareholders, the scope of a term sheet is much broader than the deal terms alone. Over the years, the notion of the term sheet has evolved into a two to five page document that contains the key terms and conditions in the broadest sense of an investment. A term sheet covers amongst others the envisaged investment, deal structure and impact on the cap-table, development roadmap of a venture, board composition (roles and responsibilities) and key governance principles.

Inherently and fundamental to venture funding is that founders and investors team-up to create value in the company. The stakeholders of a venture deal consist of at least the following categories:

- Company

- Founders

- Investors

In many situations though, many more categories exist such as team members, clients or partners. For simplicity reasons I continue in this article with the first three categories.

The Term Sheet Building Blocks

Successful and effective venture funding negotiations take into account four perspectives:

- Funding need

- Investor return

- Valuation

- Risk management

I call these perspectives the the building blocks of term sheet negotiations.

Clearly, the starting point of the building blocks may be different for the company, the founders or the investors. However, with the right deal terms in place a win-win structure could be achieved. Once the building blocks are aligned with the stakeholder objectives and requirements, the deal terms can be agreed in the term sheet.

Summarised the flow of venture negotiations will be as follows:

The ‘Term Sheet Quadrant’

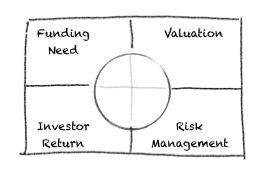

To facilitate founders and investors to agree on the key deal terms taking into account the stakeholders needs, objectives and conditions, I recommend using the Term Sheet Quadrant. I have developed the Term Sheet Quadrant for training purposes and to facilitate venture teams and investors to better understand and design the key terms and conditions of a venture deal.

The Term Sheet Quadrant consists of four building blocks and a circle in the middle. The edges of the quadrant – outside of the circle – are reserved for the startup needs, the founder objectives and the investor requirements. The four areas inside the circle are reserved for the the chosen deal terms. In an optimal situation, the deal terms reflect the the startup needs, founder objectives and investor requirements from the perspective of funding need, investor return, valuation and risk management.

The building blocks of the Term Sheet Quadrant

Now we have introduced the Term Sheet Quadrant, I will discuss each of the building blocks from the perspective of the startup needs, the founder objectives and the investor requirements. In addition, I will give a couple of examples of deal terms. These could be both supportive as well as preventive to mitigate concerns.

As I will only include illustrative examples of deal terms, I refer for more information on the most common venture capital deal terms to an overview published by CB Insights

Quadrant I – Funding Need

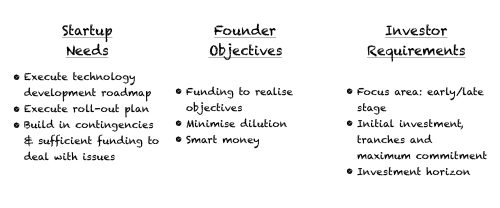

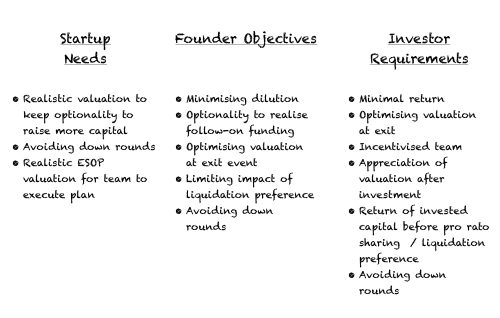

In the first quadrant, the following non-exhaustive list of funding related topics could be discussed from the perspective of the startup needs, founder objectives and investor requirements.

Common deal terms that reflect the funding needs are ‘milestone driven investment tranches’, ‘additional funding commitments’ such as convertible loan facilities, and ‘commitments to co-invest in future funding rounds’, such as ‘pay to play’ provisions.

Quadrant II – Valuation

In the second quadrant of the Term Sheet Quadrant, the following illustrative list of valuation related topics can be discussed from the perspectives of the company, founders and investors.

Often seen deal terms that cover valuation considerations are ‘liquidation preferences’, ‘ratchets’, and ‘earn-outs/ins’, all creating a differentiated ex post valuation subject to the realisation of agreed criteria.

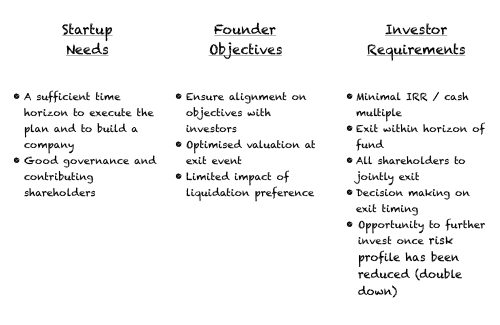

Quadrant III – Investor Return

In the third quadrant, investor return related topics will be discussed. Even though the investors will be in the driving seat, you will find that founders may have their views on the distribution of return as well.

In order to optimise the chances of realising the envisaged return, investors require some or more of the following terms in a term sheet: ‘liquidation preference’, and a ‘drag & tag along’.

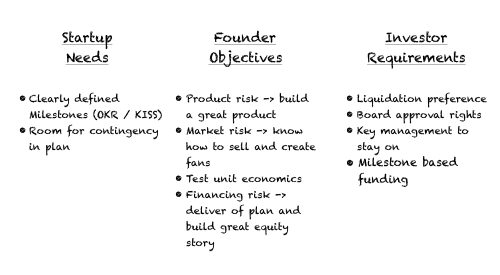

Quadrant IV – Risk Management

In this quadrant, the following list of risk management related topics could be discussed as part of the startup needs and investor requirements.

To mitigate the identified risks, the venture capitalists have become masters in the art of taking out the risks of the companies they invest in. Investors have several instruments to bring the investment proposition to an acceptable risk level without loosing sight of the upside. Two examples:

- Investors provide their funding through tranches which are conditional to a startup reaching agreed milestones. With the startup realising its milestones, more funding will be provided while the risk profile has decreased. Or to put in the words of Annie Duke and Marc Andreesen “In a probabilistic environment with an uncertainty of outcome you need to focus on process (vs outcome)”.

- Investors tend to leave some risk categories with the founders. A good example is the risk that a startup will be sold at a much lower price than envisaged. In that case investors require their invested capital to be returned to them before other shareholders will receive their pro rate share.

Investors require certain ‘board approval rights regarding amongst others business plan, funding recruitment and exit’, ‘vesting of the shares of key management’, and ‘milestone based funding’.

Through the four lenses of the quadrant, founders, and investors learn to understand each others objectives and constraints. More importantly, the Term Sheet Quadrant serves as a tool to understand the strong interdependencies between funding needs, return requirements, valuation and risk management. For example, in venture deals, the implied valuation in a funding round cannot be seen in isolation from the return requirements. Similarly, the notion of milestone based funding commitments reduces the risk profile of a startup.

Deal structuring – the inner circle of the Term Sheet Quadrant

Once the startup needs, founder objectives and investor requirements have been listed on the canvas, the inner circle is meant to write down possible solutions and deal terms. For some startup needs and investor requirements it is easy to come up with a reasonable solution that works for all parties. Other needs, objectives or requirements may be contradictory at first sight. For those situations, the solution is often found by re-assessing the four dimensions of the Term Sheet Quadrant again and to consider the time-dimension. For example, if the pre-money valuation is a blocking issue, investors may agree on a ‘ratchet’ which is a mechanism to re-balance the initial valuation if later on certain milestones have been achieved. A ratchet touches on valuation, risk-management and investor return. The startup will be awarded a higher valuation ex post its risk profile has been reduced or if the IRR threshold has been achieved at exit.

How to apply the Term Sheet Quadrant?

I recommend to print the Term Sheet Quadrant on a canvas, preferably A0 format and to have different colours of Post it Notes available. Once prepared, the venture team starts to design the venture deal in three steps.

Step 1 – write down the needs, objectives & requirements

Each participant starts to write the needs, objectives and/or requirements on Post-it notes. The four categories of the Term Sheet Quadrant facilitates the participants to look at several perspectives:

- Four different angles: startup funding needs, investor return requirements, valuation and risk management, and

- Different stakeholders: e.g. startup, founders, team and investors

I recommend to use for each stakeholder a different colour, e.g. green for the company, yellow for the founders and blue for the investors. Once all needs, objectives and requirements have been plotted on the Term Sheet Quadrant, the facilitator starts to group the Post-it notes. Many Post-it notes will be similar or overlapping, yet others may be conflicting.

Step 2 – explore deal structures and key deal terms

Once all needs, objectives and requirements are clear for all stakeholders, the facilitator who is often an advisor or a trusted investor starts to discuss potential deal terms. I recommend to first agree on the ‘easy’ deal terms which cover the joint needs, objectives and requirements. Thereafter, deal terms will be proposed to address objectives or concerns of each stakeholder group (i.e. the investor or company). This way deal terms will be proposed and discussed for all needs, objectives and requirements of all stakeholders. Please note that in this phase no negotiations take place. The purpose of the explore phase is to understand the possible deal terms and options.

Step 3 – term sheet design & negotiations

The last step is to negotiate the key deal terms and to design the envisaged deal structure. The final deal structure will be reflected in the term sheet. As said before, the term sheet covers amongst others the envisaged investment, deal structure and impact on the cap-table, development roadmap of a venture, board composition (and roles and responsibilities), and key governance principles. A well designed venture is not only complex, the outcome needs to satisfy all stakeholders.

Conclusion

Capital raising is a key activity of a startup whereby founders, the venture team and investors team-up. Together, they build a product, find a product-market fit and prepare for scaling. Venture funding has become a specialised industry. It provides tailored funding to the different phases of the startup journey.

A well designed venture deal takes into account four perspectives: funding needs, investor return, valuation and risk management.

Despite the standardisation of venture capital documentation, not all startups fit to the requirements of the venture capital modeland often the deal structure needs to be tailored to specific circumstances and the growth phase of the startup. Therefore, I recommend founders to read up on venture capital deals terms. Understanding the venture funding mechanisms is fundamental to negotiate a better deal that serves the startup growth and founder objectives and investor requirements. The Term Sheet Quadrant facilitates founders and investors to better understand their needs, objectives and requirements and to negotiate the best deal.

Note – this article is an Alpha version. Based on feedback from readers and workshops, I will review and update this article regularly.

A downloadable poster format of the Terms Sheet Canvas will become available on openincubation.com